Training, Budgets and Costs SDMS V Staff Development and Learning Management for Windows provides the most comprehensive training and administration software available to the staff development professional. Its financial module provides Training Managers with full and flexible control of all aspects of training financials as standard. |

|

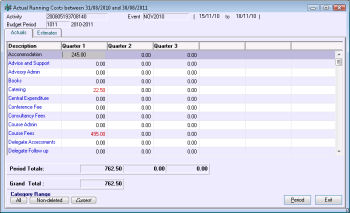

All budget periods and cost types are fully user definable to suit your financial and planning year. Estimated costs can be entered for activities, scheduled training events, training sessions and delegates. Actual costs with calculation of best estimates of spending outturn can also be recorded for activities, scheduled training events, training sessions and delegates. Costs can be tracked against subject area or types of training provided, groups and departments as well as individuals or providers. Data entry is via a simple Excel™ Style screen: |

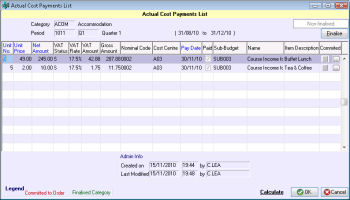

Recording Central Expenditure Central expenditure can also be managed with all overhead expenditure in a Budget Period entered and viewed from a single screen; monitoring Orders and Payments is simple and effortless. Each item of expenditure is assigned a Cost Category, Cost Centre and Nominal Codes for linking to financial systems and associated with a sub-budget for monitoring allocated funds against expenditures. |

|

|

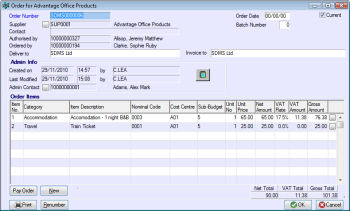

The system not only embodies the most modern approaches to training administration and management, but also supports full financial and budgetary control. Using the SDMS Payments Manager further extends the functions of SDMS for the control and monitoring of the costs of training, adding full ordering and payments processing. This either allows the training function to undertake its own ordering and payments or aids the reconciliation with corporate finance systems. For all costs associated with training; standard orders can be produced and sent directly to suppliers of training goods and services or act as a request for order and payments to corporate finance systems. Payments received with full details can be then recorded against orders. SDMS Payments Manager allows the user, while entering costs into the SDMS Staff Development cost screens, to enter details for order number, batch number, supplier’s invoice number and a description of any of the items making up the cost. These then automatically appear in the order management facilities. Order details include: order number, date of order, batch number, supplier, authorised by, ordered by, delivered to and invoice to details. Each order allows multiple items, assignment to nominal or detail codes, assignment to training cost category, item description and amount. VAT is automatically calculated on entry. Alternatively, orders can be entered in the order management section and against each order item an indication of the training activity and/or delegate enrolment can be entered. These then appear automatically in the costs section. As with the cost system in the main modules of SDMS V Staff Development, nominal codes can be entered against each line in an order, providing a means of reconciling and linking financial data within the payments module with other financial systems. Orders and payments management are facilitated by the maintenance of a full and comprehensive Supplier Record. This not only includes supplier name, addresses, telephone numbers, fax, email and contact names, credit limit, payment to and VAT Number, but also full bank details to aid EFT (electronic fund transfer). In addition, the type of training resources supplied including names of Consultants and Tutors are held. All orders placed with a given supplier can be viewed via a pull-up list. The management of payments is facilitated by holding full transaction details including amount paid, cost type, nominal code, payment date, fully paid, and of course corresponding order and item number. Part payment, including pre-payments for services, is also supported. With SDMS Payments Manager, all payments associated with training can be analysed and viewed by training area, course, delegate, type of course and department and of course budgets and cost centres. |

|

Monitoring Training Budgets Single and multiple budget structures are supported. The hierarchical budget structures are user definable, with the ability to insert new sub-budgets and obsolete ones that become out of date to extend the period the budget structure is in use. When organisational restructuring requires completely new budget structures, these can be defined keeping the monitoring of expenditure in line with needs and demands of changes. Funding allocations for each sub-budget can be designated and total budget figures viewed and reported on. |

|

SDMS Payments Manager

|

|

|

|

| In addition, a specific order generator is provided, together with a supplier details report. SDMS Payments Manager has been designed for training and staff development departments needing the highest levels of financial control and management. | |

| SDMS Revenue Manager | |

The system not only embodies the most modern approaches to Training Administration and Management, but also supports full financial and budgetary control. |

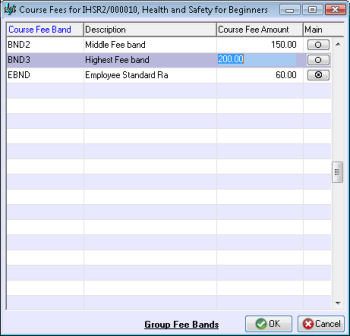

Using the SDMS Revenue Manager further extends the financial functions of SDMS to the management and processing of invoices for the sale of training places, courses and consultancies. This module either allows the training function, operating as a business unit, to undertake its own invoicing and debtor control or aids audit and reconciliation with corporate financial systems. For all income and revenues associated with training, standard invoices can be produced and sent directly to customers buying individual training places, or whole courses, or can provide a request for invoicing to corporate financial systems. Invoice receipts with full details can then be recorded against invoices. SDMS Revenue Manager allows the user, when enrolling delegates, to enter whether they are a fee payer or not and at what fee band they should be charged. Delegate name, the organisation they belong to if appropriate, whether they are accepted for the course and details of attendance can all be held. Banded fees can be defined and block bookings managed. Details entered during delegate enrolment automatically appear in the invoice management option. |

| Recording Extra Income | |

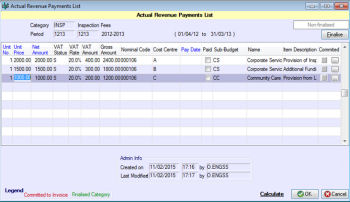

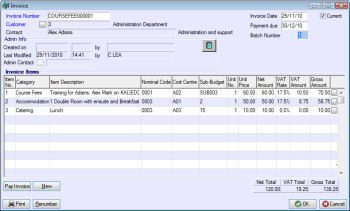

Extra Income can also be managed; with all extra income that the organisation receives being recorded against a Budget Period and viewed from a single screen so monitoring Invoices and Revenues is simple and effortless. Each item of income is assigned Cost Category, Cost Centre and Nominal Codes for linking to financial systems and associated with a sub-budget for monitoring allocated funds against income received. Invoice Details: Invoice details include: invoice number, date of invoice, customer, batch number and payment due date.

|

Each invoice allows multiple items, assignment to nominal or detail codes, assignment to training revenue category, item description, amount and total. VAT is automatically calculated on entry. Details on when the Invoice was created, who it was created by and for which organisation it is associated with are also recorded. All invoices issued to a customer can be viewed via a pull down list. The control of paid invoices is facilitated by holding full transaction details including: amount received, revenue category, and nominal code, date paid, fully paid, and of course corresponding invoice and item number. Part payments of invoices are also included. |

| Alternatively, invoices can be entered in the invoice management section and against each invoiced item the delegate enrolment can be entered. | |

These then appear automatically in the revenues section against the enrolment. As with the cost system in the main SDMS V Staff Development system; nominal codes can be entered against each line in an invoice, providing a means of reconciling and linking financial data within the revenue module with other financial systems. Invoicing and receipts control are facilitated by the maintenance of a full and comprehensive Customer Record. This not only includes customer name and addresses, telephone numbers, fax, e-mail and contact names, but also payment methods, credit limit and full bank details to aid EFT (electronic fund transfer). With SDMS Revenues Manager all income associated with training can be analysed and viewed by training area, course, delegate, type of course and customer. In addition, specific reports for Full Invoice Generator, Invoice Summary, Unpaid and Partly Paid Invoices, Invoice Payment Breakdown, Course Fee Invoicing and Customer Details Report are supplied. SDMS Revenues Manager has been designed for training providers operating as fully independent commercial operations, and internal training functions wishing to charge internal as well as external customers. |

|

| Batch Entry of Costs and Revenues | Reporting |

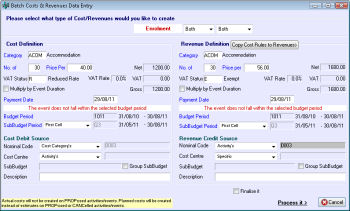

Where the same amount of expenditure or income may be allocated to a group of individual delegates on a training course, the Batch Entry screen allows the basic details to be recorded including the Category, Number of Items, Price per Unit, VAT Status, Payment Date, Budget Period. The Source of the Expenditure or Income can be set to use the Activity, Category or Specific Nominal Code. Then the individuals that the details are to be recorded against can be chosen and the necessary records built against their enrolment attendance allowing for an accurate view of the course of Training to specific Groups / Schools to be monitored along with the Income information which the Training Course has generated. |

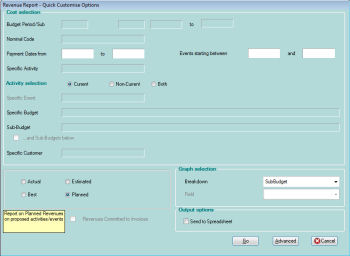

An enhanced feature of SDMS V Software is the Report Viewer and Editor, which allows full user control over report outputs, including font style and size, bolding, underlying, cut and paste and many other word processor features, together with report output file management, including Save As and Open. Appropriate reports include pie and bar chart options at the click of a button in addition to the normal text and columnar output form.

Each report comes with extensive customisation that enables report criteria to be defined and sub sets of date to be reported. Interrogation of the data using the customisation means real and useful information is extracted for reports. In addition, reports can be output to Excel™ where analysis tools can be applied to the raw data. An import feature of Financial Reports is the ability to select the type of cost to be reported. |

|

|

| Export of Details to Finance/General Ledger System | |

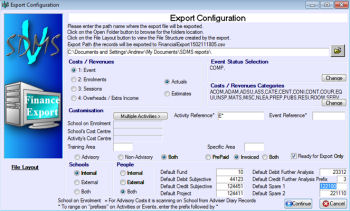

For those organisations that need to provide their Finance Department with the details of the expenditure and income generated within the training team; we are able to provide an export facility that will transfer the necessary information to a file which can then be imported into the organisations General Ledger System.

This will allow the organisation to raise internal journal transfers for the hire of their rooms and cost of catering charges, the sale of publications and books, the hire of equipment and the use of their advisory services and consultants to outside agencies. |

|

Finance Export Configuration Screen

Finance Export Configuration Screen